Investment Summary

Validated CXCR4 mechanism provides high scientific confidence. Successful trial in WHIM, and its eventual approval, should provide a PRV. CN is the biggest market and overall we expect success in that indication and the eventual market launch.

However, the CN trial update has recently been spotty. We expected more data than just 3 patients in the last update. More worryingly, multiple sites have withdrawn from the ongoing CN trial which could slow recruitment. A data update is scheduled for ASH but the number of patients to be presented is unclear. Variability in type of data shown, and its importance (e.g GCSF tapering, ANC levels etc), could lead to fragmented evaluations from the market and a muted response.

Value is cheap at these levels and further clarity will emerge after ASH data.

Near Term Catalysts

WHIM NDA submission - Q4 2023

ASH CN presentation - Q4 2023

Company Overview & Pipeline

XFOR is a 70 person company developing mavorixafor (a CXCR4) in WHIM and Chronic Neutropenia (CN).

Mavorixafor was in-licensed in July 2014 from Genentech as part of patents related to CXCR4 receptor. As part of the deal XFOR will have to pay Genentech an additional $7M in regulatory milestones and tiered royalties.

Recently XFOR was granted new patents that extend the COM patent expiration to 2038. Originally the Genzyme licensed patents for mavorixafor composition appeared set to expire between 2024 and 2027.

XFOR is essentially a one product company, totally dependent on mavorixafor for its valuation. Mavorixafor in turn is on the cusp of 2 critical value inflexion points in WHIM and CN. It recently had a positive phase III in WHIM and is submitting an NDA to the FDA. Since WHIM is a rare pediatric disease XFOR is eligible to recieve a priority review voucher upon Mavorixafor’s WHIM approval. In CN, XFOR completed a small phase I trial, is currently conducting a phase II trial, for which data on 3 patients was recently revealed, and is planning a phase III trial.

Indication Landscape

Blood neutrophil homeostasis is essential for successful host defense against invading pathogens. Neutrophils are produced and stored in the bone marrow and undergo a controlled release into the bloodstream regulated by CXCR4 and its ligand CXCL12.

WHIM:

WHIM syndrome (warts, hypogammaglobulinemia, immunodeficiency, and myelokathexis) is a rare autosomal dominant immunodeficiency disorder attributable to mutations in CXCR4, which prevent the normal release of mature neutrophils from the marrow into the blood. No treatments address the underlying disease, with GCSF and anti-biotics often used for symptomatic relief.

The laboratory manifestations include leukopenia, severe neutropenia, profound lymphopenia, and monocytopenia that result in recurrent bacterial infections and unusual susceptibility to certain viral infections, which have been linked to a higher incidence of cancer. Bacterial infections frequently present as pneumonia, recurrent otitis, sinusitis, or cellulitis and are associated with chronic morbidity.

Asset Data

Mavorixafor:

Mavorixafor is a small molecule antagonist of chemokine receptor CXCR4. Mavorixafor binds to the extracellular region of the CXCR4 receptor and specifically and reversibly inhibits receptor signaling of the most common pathogenic CXCR4 variants (R334X and E343X) and wild-type CXCR4 receptors. The mode of action is allosteric - this means it doesn’t bind to the active site; instead it binds somewhere else on the receptor and likely causes a structural change that prevents the protein from performing its function.

WHIM:

Mavorixafor was tested by XFOR in a phase II (X4P-001-MKKA) and phase III study (NCT03995108).

The phase II trial was a small, open label 8 patient study conducted in 2 sites in the US and Australia. The dose was escalated from 50mg to 400mg once daily.

A dose dependent increase in white blood cells was observed., and the infection rate also declined with dose / time.

While there’s an increase in the ANC and ALC levels that appears dose dependent at the lower levels, the increases stop with the 300mg and 400mg doses. However, other plots show that the 400mg might have a slightly higher effect than the 300mg dose.

The phase II provided positive initial data for mavorixafor and established 400mg as the desired therapeutic dose.

The phase III trial was open label and patients got 400mg of mavorixafor once daily for 52 weeks in the randomized portion.

The WHIM phase III was successful in Nov, 2022 with the primary (time above threshold - ANC) and a key secondary endpoint (time above threshold - ALC) met. .

Additionally, it seemed the increased neutrophil count dramatically decreased the incidence of infections, particularly with time. Almost every type of infection was lower in the treatment group, and the infections was far less serious (7% of mavorixafor patient had a grade3+ AE vs 29% for the placebo patients). Consequently mavorixafor patients needed far less antibiotics.

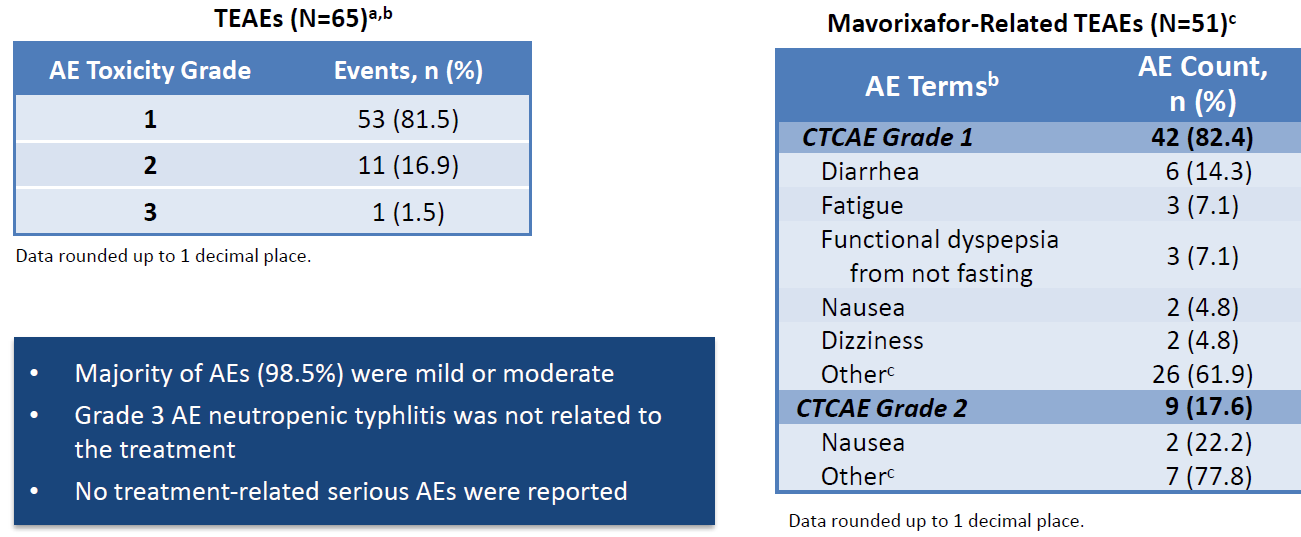

The AE information seems OK, though a more granular breakout of AEs (eg. by grade) is necessary. Overall, it seems mavorixafor causes increased GI disorders and skin issues. The exact nature of these AEs needs to be further investigated.

Interestingly, mavorixafor caused more thrombocytopenia than placebo - keep an eye on it for future studies. The AE tables here suffer from a small N so it is difficult to read into the magnitude of impact for any particular AE. The skin issues (rash, rhinitis, pityriasis etc) are also worth watching. They are small enough currently to not be an issue but given Intercept’s tribulations with the FDA it could become problematic if it surfaces in larger trials.

The data are quite positive, particularly in such a rare disease and should be sufficient for approval. However, there are a few oddities:

Unclear what time-point XFOR used in the bar graphs

The Mavorixafor efficacy / impact appears to decrease over time

At week 52 the placebo and treatment confidence intervals overlap, though that might be due to 3 of the 17 placebo patients getting mavorixafor in advance of the measurements as they prepared to enter the open label study phase.

Tx patient number drops to 9 at week 39 and then back to 10 in week 52. Unclear why tx patient numbers bounce around.

Chronic Neutropenia (CN):

Chronic neutropenia is defined as periods lasting more than three months persistently or intermittently where there are abnormally low levels of neutrophils circulating in the blood, and may be idiopathic (of unknown origin), cyclic (episodes typically occurring every three weeks), or congenital (of genetic causation). Injectable GSCF is the only approved therapy (for idiopathic, cyclic and congenital severe CN). It requires multiple visits for dose titration and carries a risk of MDS plus quality of life issues.

The epidemiology of CN isn’t well established. XFOR estimates about 50K chronic neutropenia patients in the US based on a variety of research methodologies. However, the actual number may be considerably less. Initially XFOR expects going after the congenital and idiopathic segments which may be ~15K patients. Again, this number is highly uncertain.

XFOR has conducted a phase I trial, is currently conducting a phase II trial and is planning a phase III trial in CN.

Phase I Trial in CN:

The phase I trial evaluated 400mg of mavorixafor in 25 patients with the primary endpoint the change in ANC levels over 6-8 hours on day 1. They were allowed a stable GCSF does if it was previously used.

All patients met the response threshold (increase in ANC >500 cells per microliter).

Regardless of CN subtype, patients saw a large increase in ANC.

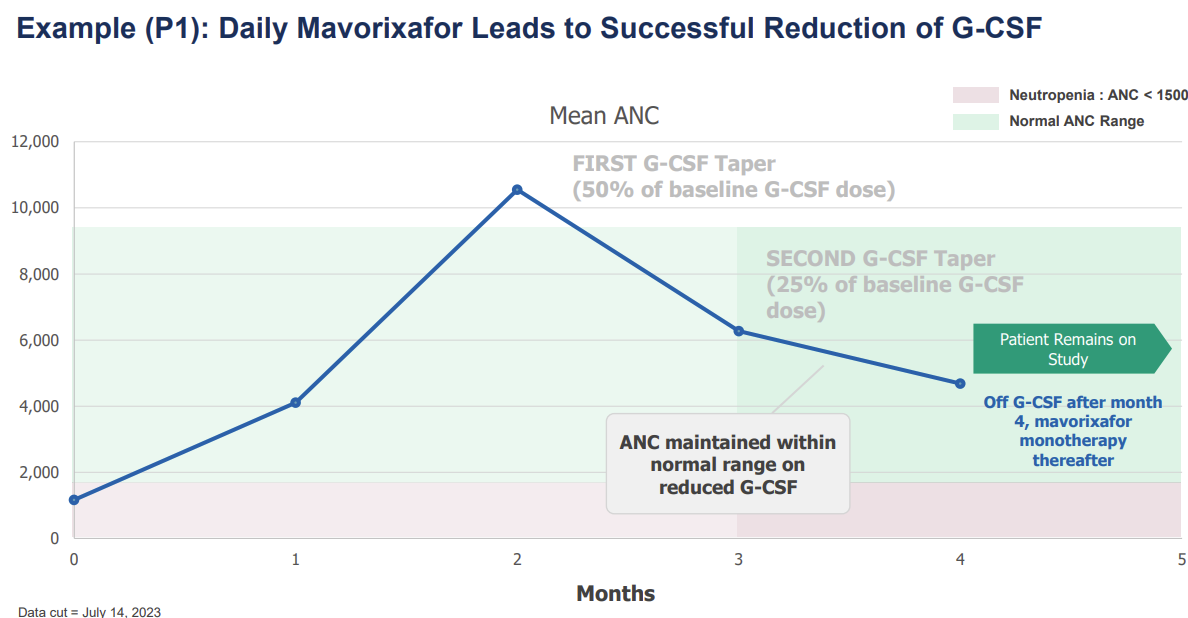

Interestingly, the drug had a positive impact on patients with and without prior GCSF therapy. The overall ANC increase was higher in patients with underlying GSCF, which should be expected given the dual mechanisms being utilized. However, mavorixafor’s ability to increase ANCs without GCSF leads to the prospect of a GCSF sparing approach.

Thoughts:

The data shown is only for 8 hours, raising potential durability of effect questions.

Without GCSF patients tended to come back down to the min normal level - Need to understand if this is sufficient. It’s likely that for some patients GCSF may be reduced and not completely withdrawn.

Safety profile is very clean - oddly no skin issues were observed.

Ph II Trial in CN:

A phase II trial is ongoing (NCT04154488). It was listed in CT.gov in Nov 2019 but is still recruiting patients. As of the Q2 call only 3 patients had 3 months of follow up, which is remarkably slow even accounting for COVID. Multiple clinical sites have withdrawn from the study (unclear why).

Additional data will be released at ASH. I expect the following for the data update:

10+ patients worth of data

Currently 3 have 3+months of data, assuming another 5 are enrolled and will have 3 months of data by ASH, and another 2-5 will be enrolled within the next few weeks and have data available by ASH

All patients will show increase in ANC, but it lowers over time.

1 patient will have levels go back to neutropenic levels OR have no impact on GCSF Taper.

Most patients will be able to taper GCSF

Some improvement in infection burden

However, while I expect the drug to work, there’s considerable uncertainty around the upcoming ASH readout due to multiple variables investors will look for. These could include:

Duration of effect (does it persist for 3 months?)

Magnitude of effect (change in ANCs)

Extent of GCSF tapering

Specific sub-populations

Effect on infections (which could be low given CN patient’s are not WHIM who have constant infections)

A phase III has been designed incorporating FDA inputs and is expected to begin in 1H 2024.

Ownership

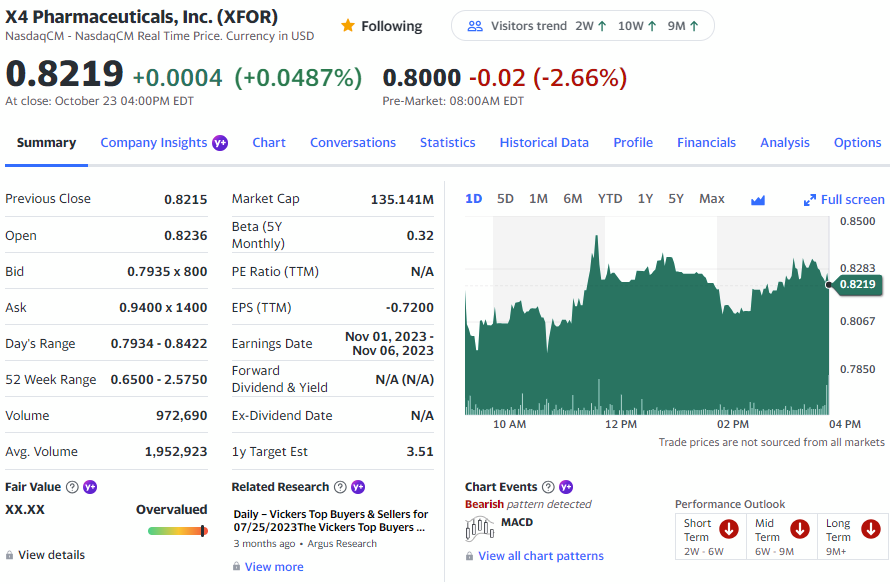

Stock Price and Valuation

Recently XFOR amended its existing loan agreement with Hercules Capital. XFOR has borrowed $32.5 under agreement, and has the ability to borrow an additional X. The effective interest rate is currently 14.1% (high!). The amended agreement delays payment terms with the first payment occurring in 2025. The total capacity to draw upon has also been increased to $115, though contingent on WHIM approval, certain clinical milestones and Hercules’ discretion.

Analyst coverage is poor, with early revenue estimates varying widely. Optimistic analysts expect revenues close to $50M, while conservative analysts are expecting $10M.

A conservative valuation places the company at $610M, which is almost 4x the current stock price. This reflects a reasonable valuation incorporating US only sales of CN, the PRV and current cash levels.