Investment Summary

Cytokinetics is essentially a bet on aficamten. It has succeeded in a pivotal phase III that could potentially lead to an approval in 2025 for obstructive HCM. Additional trials are ongoing in non-obstructive and obstructive HCM that will likely drive uptake and additional indications.

Pros:

Highly de-risked with successful phase III

Prime take out candidate

Considerably better safety profile than competitor (mavacamten)

High unmet need indication with few alternative therapies outside this MOA

Cons:

Company lacks commercial expertise and may need a partnership / buyout to effectively compete against BMS’s marketing muscle

While current trials have been successful, there’s always a risk of unforeseen findings arising in later trials.

The available non-obstructive HCM data, while positive, is early.

High debt burden (>$500M); maturing in 2027

Commercial potential might be overstated based on mavacamten experience

Near Term Catalysts

The major catalysts all revolve around aficamten’s regulatory submission and eventual launch.

Aficamten Regulatory Submission: 2H 2024

Aficamten FDA Approval: 1H 2025

Company Overview & Pipeline

Cytokinetics is a specialty biotech focused on developing therapies that address specific muscle disorders. Their primary focus is currently on cardiac muscles with multiple pipeline assets pursuing cardiovascular indications. However, they also have early programs in skeletal muscle. The scientific focus is on targeting a molecular structure called the Sarcomere, which is found in cardiovascular and skeletal tissues and is an important component for generating contractile foce.

Source: Cytokinetics Corporate Presentation 2024

Aficamten is undoubtedly Cytokinetic’s crown jewel. It recently generated positive topline results from the phase III SEQUOIA-HCM trial and a regulatory submission is being planned. Follow on indications are expected in the coming years and it alone is likely to become a multi-billion dollar asset.

Indication Landscape

Hypertrophic Cardiomyopathy (HCM):

HCM is a relatively common genetic cardiac disease with left ventricular hypertrophy and myocardial hypercontractility that eventually lead to left ventricular outflow obstruction. Clinical manifestations vary considerably resulting from the diverse genetic makeup of the disease and changes in heart function that accompany the genetic mutations. Patients may exhibit myocardial fibrosis, coronary vessel abnormalities, valve abnormalities and tachyarrhythmias.

HCM is often characterized into obstructive and non-obstructive HCM. Obstructive HCM (oHCM), features hypertrophy that results in obstruction of the blood leaving the left ventricle and leads to an increase in the left ventricular outflow tract (LVOT) pressure gradient. It’s estimated that 1 in 500 people carry genetic mutations that increase susceptibility to HCM, with approximately 1 in 3200 developing HCM. About two-thirds of HCM patients develop obstructive HCM (link).

Cytokinetics estimates about 200K oHCM patients in the US with an additional 400K-800K undiagnosed patients.

Source: Cytokinetics corporate deck (March 2024)

Patients slowly develop left ventricular dysfunction (systolic or diastolic) with symptoms increasing in severity over time. While acute complications can often be managed, there are limited therapies for slowing the progression of HCM. The current treatment paradigm relies on mostly old, generic drugs such as calcium channel blockers or beta blockers, which are also relatively non-specific.

Current Drugs for HCM – Source: Link

New compounds addressing hypercontractility by targeting myosin have recently been investigated, with the first myosin inhibitor, called mavacamten or CAMZYOS, gaining approval in April 2022 for obstructive HCM. Myosin inhibitors help re-establish the cardiac muscle’s ability to generate contractile force by reducing the actin–myosin interactions in cardiomyocytes. This decreases the cardiac contractility that is pathologically enhanced in HCM (link). Cytokinetic’s aficamten is a next generation myosin inhibitor that hopes to overcome some of mavacamten’s limitations.

Asset Data

Aficamten:

Aficamten is a next generation cardiac myosin inhibitor specifically designed to overcome the limitations of mavacamten, which include a long half-life of 7-9 days that makes individual dose titration difficult and results in a long wash out period in the event of on-target toxicity. Additionally, mavacamten has potential for drug-drug interactions based on CYP3A4 and CYP2B6 data in human hepatocytes (link). Its patent expires in 2039 (link).

Aficamten was designed with a short half-life to enable daily dosing, limited CYP-induced drug-drug interactions and a wide therapeutic window. It is being investigated in a broad clinical development program in HCM.

Source: Cytokinetics Corporate Deck (March 2024)

SEQUOIA-HCM Trial:

SEQUOIA is Cytokinetic’s registrational phase III trial that recently read out positively in Dec 2023, with full results to be presented in a medical meeting.

Source: Cytokinetics Corporate Deck (March 2024)

According to Cytokinetics the primary endpoint and all secondary endpoints were met with statistical significance.

Source: Cytokinetics Corporate Deck (March 2024)

Since specific numbers were not provided it’s difficult to gauge aficamten’s impact. Data provided by dosing levels will be key to evaluate. We’d like to see greater effect size with dose. AE details will also need to be monitored, as will drug-drug interactions. The data will likely be presented at a conference in Q2 or Q3 2024.

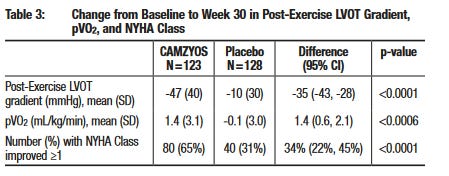

Mavacamten is approved for oHCM and is the defacto standard of care. It’s interesting that aficamten wasn’t compared against mavacamten despite the SEQUOIA trial starting close to mavacamten’s approval date. Hence, we will have to rely on cross trial comparisons to determine the comparative efficacy of the two agents. While efficacy may be difficult to compare, safety should be easier as mavacamten has a black box warning for heart failure. If aficamten’s safety profile is in line with prior trials we expect a cleaner label. Mavacamten’s efficacy is below and will be the barometer to judge aficamten. Additional data are in the mavacamten PI (link).

Source: mavacamten Prescribing Information

So how does aficamten compare with mavacamten? It’s hard to say - mavacamten data is by number of responders while aficamten provides a mean pVO2 level. Mavacamten increased mean pVO2 by 1.4 (aficamten value is 1.74), but cross trial comparisons, patient differences and other factors essentially make them equivalent.

REDWOOD-HCM:

The REDWOOD-HCM trial was a randomized evaluation of various dosing profiles in patients with obstructive HCM.

Source: Cytokinetics Corporate Deck

Most patients treated with aficamten (78.6% in Cohort 1 and 92.9% in Cohort 2) achieved the treatment target of reducing the resting gradient below 30 mmHg and the post-Valsalva gradient below 50 mmHg by week 10 (link).

Source: Cytokinetics Corporate Deck

Importantly, critical biomarkers also showed improvements and NYHA class showed a >1 change improvement for most patients.

Source: Cytokinetics Deck

Even more impressively, the improvements revered back to placebo values during the washout period. The change was reasonably quick with treated patients having values similar to placebo patients in 2 weeks. The rapid changes should help physicians with titrating doses as needed. Additionally, the results appear dose dependent, which is always a good sign. Aficamten produced a profound reduction in LVOT gradients within 2 weeks of therapy, with complete hemodynamic response in the majority of treated patients. By comparison, a complete hemodynamic response was only met in 27% of the EXPLORER-HCM treatment arm, albeit with a more rigid definition of reduction (link).

The patient level data is even more interesting. While there is considerable variability between patients, they all have the same trend.

Source: https://onlinejcf.com/action/showPdf?pii=S1071-9164%2823%2900261-0

Cohorts 1 & 2 had no serious AEs and no meaningful changes in QTc intervals.

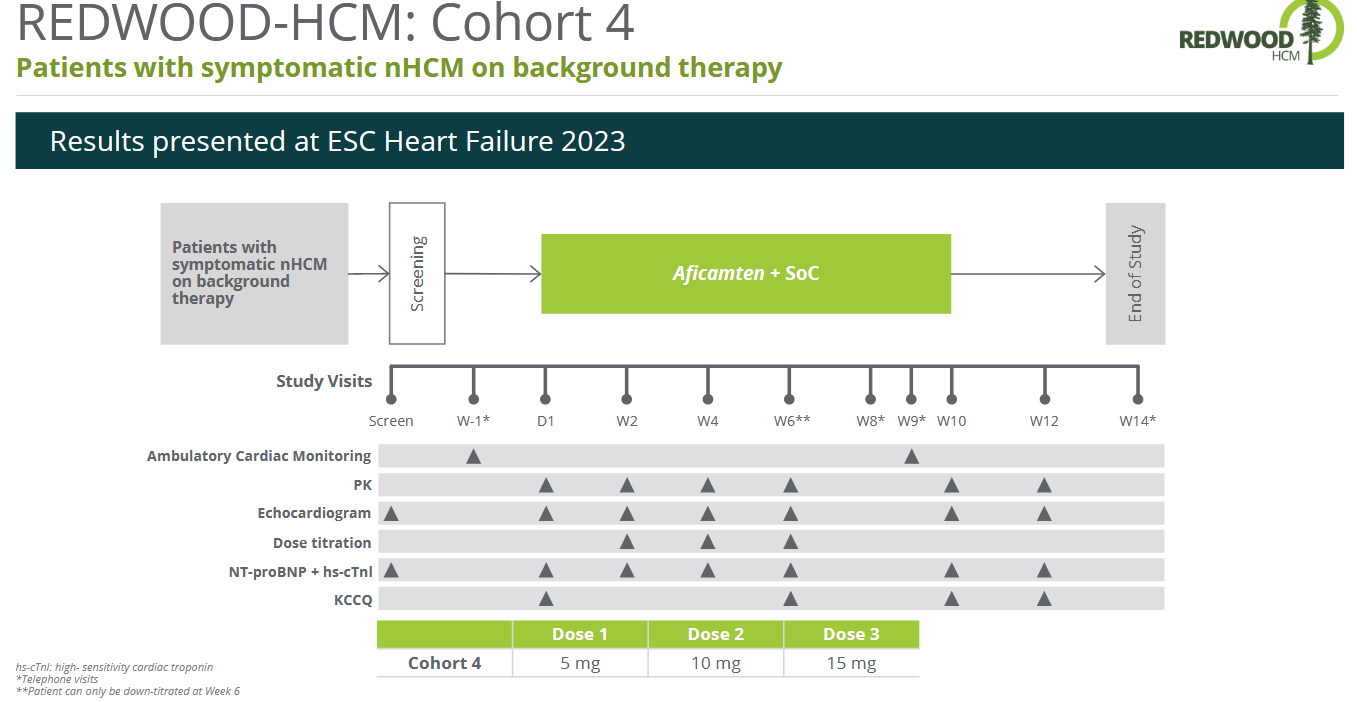

Cohort 4 of REDWOOD-HCM investigated patients with non-obstructive HCM with NYHA class II-III.

Source: Corporate Deck

Efficacy data showed improvements in Kansas City Cardiomyopathy Questionnaire Clinical Summary Scores and key biomarkers (NT-proBNP, high-sensitivity cardiac troponin). Aficamten was generally well-tolerated. By Week 6, 35 (85%) of patients achieved the highest dose of 15 mg of aficamten, and 6 (15%) achieved 10 mg. There were no drug discontinuations due to adverse events. One dose reduction to 10 mg occurred due to fatigue, and one temporary dose interruption occurred due to palpitation. Three patients had serious adverse events, but none were attributed to aficamten. In 27 patients (66%), at least one treatment emergent adverse event was reported (link).

FOREST-HCM is an open label extension study for the REDWOOD-HCM trial, and patients in the SEQUOIA-HCM trial. [Note: the trial was originally named REDWOOD-HCM OLE, but when the eligibility criteria was expanded to included SEQUOIA-HCM patients it was renamed to FOREST].

Over 200 patients have been enrolled and data from ~143 patients highlight an improvement in biomarkers and key clinical features.

Source: Cytokinetics Corporate Deck

Source; Cytokinetics Corporate Deck

Omecamtiv Mecarbil:

Having received a CRL, Cytokinetics has no plans for additional trials but will continue to push for a European approval. We will assume this asset is completely written off.

Ownership

Stock Price and Financials

Cytokinetics saw a massive spike in share price with the successful SEQUOIA-HCM phase III readout, though the stock has given up some of its gains. This post data drop often occurs with biotechs as investors start to focus on other catalysts or take profits. In Cytokinetics’ case investors were expecting an immediate buyout and seemed disappointed when the company announced plans for commercial launch.

Cytokinetics has a significant debt burden that will have to be paid back in 2027. Though this is post aficamten’s expected approval its revenues will likely not be able to sufficiently cover the debt repayment. Hence, CytoKinetics will likely have to tap the equity markets or do a debt refinancing.

Source: 2023 10K

As the first myosin inhibitor, mavacemten provides a direct comparator for revenue estimates. However, mavacamten sales have been relatively slow - despite being approved 2 years ago it only registered $88M in global sales in Q4 (full year sales of $231M), even with BMS’ marketing muscle (link). While its safety profile and black-box warning are obvious factors for the modest sales performance, it raises questions about the reasonableness of any overly aggressive aficamten projections. Cytokinetics state that their market research indicates mavacamten’s modest performance are the results of the required REMS program, potential drug-drug interactions and dose titration issues (link). Note that upon launch mavacamten sales were projected to be $1B by 2025 (link), and based on 2024 data it seems mavacamten will fall well short of that mark.

Analysts expect median revenue of ~$510M in 2026, which, assuming a 2025 launch, appears aggressive. While the drug could eventually hit $1B in sales, it may take time without the backing of a large pharma company. And mavacemten, although expected to be an inferior product, has physician familiarity and the marketing heft of BMS.

At a $7.5B market cap CytoKinetics seems appropriately valued. A takeout offer could potentially offer a 30-50% premium. The valuation might get closer to $10B as regulatory conversations progress and an approval is eventually secured.