Investment Summary

High risk upcoming PDUFA in hyperphosphatemia with risk compounded due to high dependence a single asset. A CRL is a reasonably possibility given prior FDA rejection and advisory committee debate on effectiveness. Even if approved, considerable uncertainty exists around the label (mono vs combo), treatment paradigm positioning and reimbursement. Though tenapanor is launched in IBS-C, future revenue expectations are tempered by the nature of the indication (low unmet need, non-life threatening, alt therapies etc). Hence, Ardelyx is heavily reliant on the hyperphosphatemia approval for future value.

An approval could lead to a meaningful pop in the stock price, but the need for a capital raise and uncertainty around launch dynamics could put downside pressure on the stock. Would treat this stock carefully if you plan on playing the PDUFA.

Near Term Catalysts

Oct 17,2023 - Tenapanor PDUFA

Company Overview & Pipeline

Ardelyx is essentially a single product company with its value reliant on tenapanor. There are also 2 other earlier stage assets RDX013 for Hyperkalemia and RDX020 for metabolic acidosis, but these are relatively early stage.

Given Ardelyx’s limited external commercialization capabilities, a number of ex-US agreements for tenapanor have been signed.

Indication Landscape

Irritable Bowel Syndrome with Constipation (IBS-C):

IBS results in frequent abdominal pain associated with changes in stool frequency. IBS significantly impacts the quality of life of patients, rates of absenteeism, and work productivity strongly correlates to GI-specific anxiety. A subset of patients have IBS with constipation (IBS-C) in which a quarter of stools are consistent with constipation. IBS-C accounts for approximately 20% to 35% of IBS cases (link). Diagnosis of IBS-C is simply based on the positive identification of symptoms.

Initial treatment is dense fiber, such as psyllium, oat bran, barley, and beans to improve stool viscosity and frequency. OTC laxatives are also extensively used, and although they can improve stool frequency they typically have limited impact on abdominal pain. Secreatagogues are also often utilized.

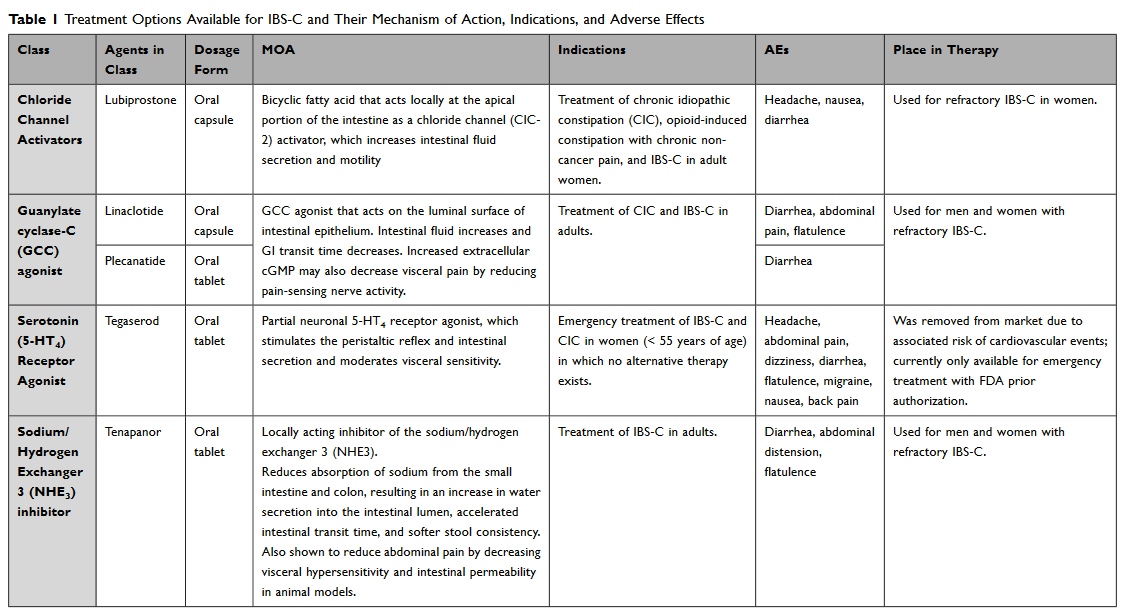

Source: Clin and Experimental Gastroenterology (2023) - link

Hyperphosphatemia:

Hyperphosphatemia is a common feature in patients with chronic kidney disease (CKD), especially in those with end-stage renal disease (ESRD). It’s a result of the deteriorating kidney’s inability to excrete phosphorus from the body, which results in dangerous levels of accumulation. Hyperphosphatemia in ESKD can lead to secondary hyperparathyroidism, renal osteodystrophy, metastatic calcification, and cardiovascular mortality. The control of hyperphosphatemia plays a key role in the management of CKD patients. However, the optimal range for serum phosphate levels in CKD patients is still under debate.

Treatment is multi-focal ranging from dietary changes to reduce phosphate intake and using phosphate binding medications. Phosphate binders are the mainstay of treatment and include calcium-containing binders (calcium carbonate, calcium acetate), the polymer-based binder (sevelamer carbonate), the metal-based binders (lanthanum carbonate, aluminum hydroxide) and the newest additions to the armamentarium, the iron-based binders (sucroferric oxyhydroxide, ferric citrate). However, the pill burden for patients is substantial, often exceeding 20 pills a day. Fewer pills could aid compliance and potentially outcomes.

As many as 80% of CKD patients in ESRD could have hyperphosphatemia. Tenapanor’s novel MOA would provide a new option for physicians, either as a monotherapy or in combination with current agents. While the overall market is large with 550K CKD patient on dialysis, the product’s predicted uptake is uncertain given all the other options available.

Source: Corporate Deck 2023

Asset Data

Tenapanor in IBD-C:

Tenapanor Is FDA approved for patients with Irritable Bowel Syndrome with Constipation (IBS-C) under the brand IBSRELA. It is a sodium/hydrogen exchanger 3 inhibitor that acts on the surface of the small intestine and colon to block the absorption of dietary sodium, resulting in increased water retention that softens stools and increases the frequency of bowel movements. This contrasts with secretagogues, which promote colonic fluid secretion.

Source: Clin and Experimental Gastroenterology (2023) - link

Interestingly, tenapanor also had an NDA submitted for a subset of Chronic Kidney Disease patients. The FDA initially issued a CRL but in May 2023 accepted a resubmission and has set a PDUFA date of Oct 17, 2023.

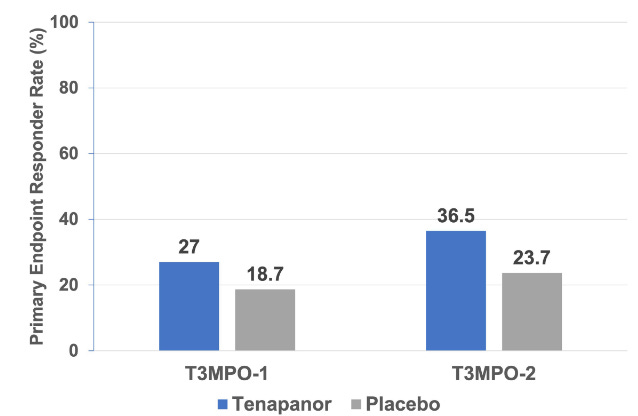

The IBD-C approval was based on two phase III trials, T3MPO-1 and T3MPO-2, with both trials showing a slight benefit for tenapanor over placebo. The FDA’s responder criteria was defined as “achieving a ≥30.0% reduction in aver-age weekly worst abdominal pain from baseline and a ≥1 per week increase in complete spontaneous bowel movements (CSBMs), both in the same week for ≥6 weeks of a 12- week treatment period”.

Source: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC10257918/pdf/ceg-16-79.pdf

Publication abstracts for both the T3MPO trials are below:

Results of both trials highlighted improvements over placebo, but the magnitude of the effect was not tremendous.

Source: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7771640/pdf/acg-115-281.pdf

Source: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC8183489/pdf/acg-116-1294.pdf

The AE profile appears acceptable, with the only major deviation from placebo being a higher incidence of diarrhea, which is expected given the drug mechanism and its intended effects. The diarrhea was also mostly transient.

Additionally, a phase III open label extension study is being conducted (T3MPO-3) on patients that had completed either of the 2 previous studies (link).

Tenapanor in Hyperphosphatemia

Tenapanor has a rocky history in hyperphosphatemia. It initially received a CRL due to questions about clinical benefit, and after a lengthy appeal process the FDA finally agreed to review the application and has provided a PDUFA date of Oct 17, 2023. A brief timeline of important regulatory events is below.

July 29, 2021: Ardelyx get CRL (link) - The FDA characterized the magnitude of the treatment effect as "small and of unclear clinical significance." An additional clinical study was requested.

Nov 4, 2021: Ardelyx plans to file a formal dispute resolution request (link).

Feb 15, 2022: FDA denies appeal (link). Ardelyx appeals the decision again to the office of New Drugs.

June 21, 2022: Ardelyx announced that the FDA Advisory Committee will review NDA on Nov 16 (link)

Nov 16, 2022: Advisory committee votes in favor of XPHOZAH (9:4 in favor of monotherapy; 10:2 in favor of combination therapy) - link

Dec 29, 2022: FDA grants appeal for XPHOZAH (link).

April 17, 2023: NDA Resubmission

The NDA package for tenapanor primarily relies on 3 phase III trials; 2 trials investigated it as a monotherapy and 1 evaluated as a combination with a phosphate binder.

Source: FDA Advisory Committee Presentation - Link

Source: FDA Advisory Committee Presentation - Link

These studies are also known as Block, Phreedom and Amplify.

The primary endpoint of serum phosphate change was debated by the FDA, and it’s unclear what the FDA considers a meaningful reduction. The use of s-P itself as a surrogate marker for meaningful clinical improvements is also debated. The trial measured reduction from baseline as the primary endpoint but clinicians typically consider an absolute level <5.5 mg/dL as important. The proportion of patients achieving that threshold was only included as a secondary endpoint.

The initial CRL was due to a perceived lack of clinical benefit, and it doesn’t appear that Ardelyx has submitted any significant additional data. The advisory meeting voted for an approval, but the discussion cements the uncertainty around clinical benefit. In particular, the monotherapy trials didn’t show a s-P change beyond what would be expected with approved phosphate binders.

Efficacy generally favored tenapanor, though the FDA questioned the large difference in patient numbers between the ITT and efficacy analysis populations (see below).

Problems were also evident in the combination study (AMPLIFY or TEN-02-202), with a relatively small duration and sample size. Ardelyx didn’t specify which binders were included and a tenapanor monotherapy arm was not included, making a direct comparison of incremental benefit impossible. However, given the complimentary MOA it’s likely that some synergy existed. And the combination may lower patient pill burden.

A full review of all tenapanor data in animals and humans is provided in this article.

Overall, the data is marginally positive and significant questions remain about the clinical effectiveness. The FDA’s initial CRL and advisory committee discussions all raised questions about the degree of benefit. The clinical development program also didn’t address whether tenapanor is best suited as a monotherapy or combination. However, it is safe, and will likely reduce patient pill burden. I think the chance of approval is reasonable, but there’s also considerable risk of another rejection. If approved, the next question will be around use as either a monotherapy or combination. Combination use appears to be the base case, and an approval for both a significant upside.

Ownership

Institutional ownership represents a substantial chunk of Ardelyx’s equity. However, the lack of specialized life science funds is concerning and could indicate little confidence in the upcoming NDA approval catalyst.

Stock Price and Valuation

Ardelyx has issued a liquidity warning with its $130M cash balance unlikely to sustain the company for the next 12 months (10Q). They are likely looking for the upcoming PDUFA in Oct to raise additional capital. Hence, if XPHOZAH is approved, expect a closely followed secondary offering.

Current IBSRELA sales are progressing well, but have limited potential given the supportive care indication (IBS-C). The unmet need isn’t great, alternatives exist and physicians will need to be convinced to prescribe.

Source: Ardelyx Corporate Deck

IBSRELA could eventually do $100-$150M in annual sales, but it’s difficult to see it grow beyond that in IBS-C, despite Ardelyx’s commercial market sizing analysis, which is error-prone. For instance, one major error is the use of TRX and $ for “IBS-C indicated products”. These products also have other indications that inflate the market being conveyed.

The real value driver is hyperphosphatemia, where an approval could open a far larger market with considerable unmet need. However, the treatment paradigm placement and payor dynamics are all open questions. I’d expect a tough initial commercial quarters post approval (if an approval is even granted).

The stock performed well over the past year as the FDA CRL saga was resolved and attention shifted to the upcoming PDUFA date.

Key Questions

How big is the IBS-C market? What is the true potential for IBSRELA?

Will the FDA approve XPHOZAH, despite efficacy concerns? Even though the advisory committee recommended an approval they had multiple concerns and the FDA doesn’t have to abide by their recommendation.

Will XPHOZAH approval be for monotherapy or combination?

Where will XPHOZAH fit in the treatment paradigm?

How does the company plan on strengthening the balance sheet?