Investment Summary

Amicus is on the cusp of achieving profitability with its 2 marketed products. Revenues are expected to grow considerably with the Pompe launch, however, the valuation already reflects future growth. The pipeline is early, and although focused on novel gene therapies, will take time to deliver POC data. The pipeline will also cannibalize market share from existing products. Hence, the company is likely fairly valued (or even overvalued) in the near term.

Near Term Catalysts

With 2 launched products and a very early pipeline Amicus is relatively catalyst poor. The largest catalyst will likely be the Q4 earnings call where revenue numbers and the ongoing Pompe launch will be discussed. However, even the effect of this catalyst has been diminished since Amicus released preliminary revenue numbers.

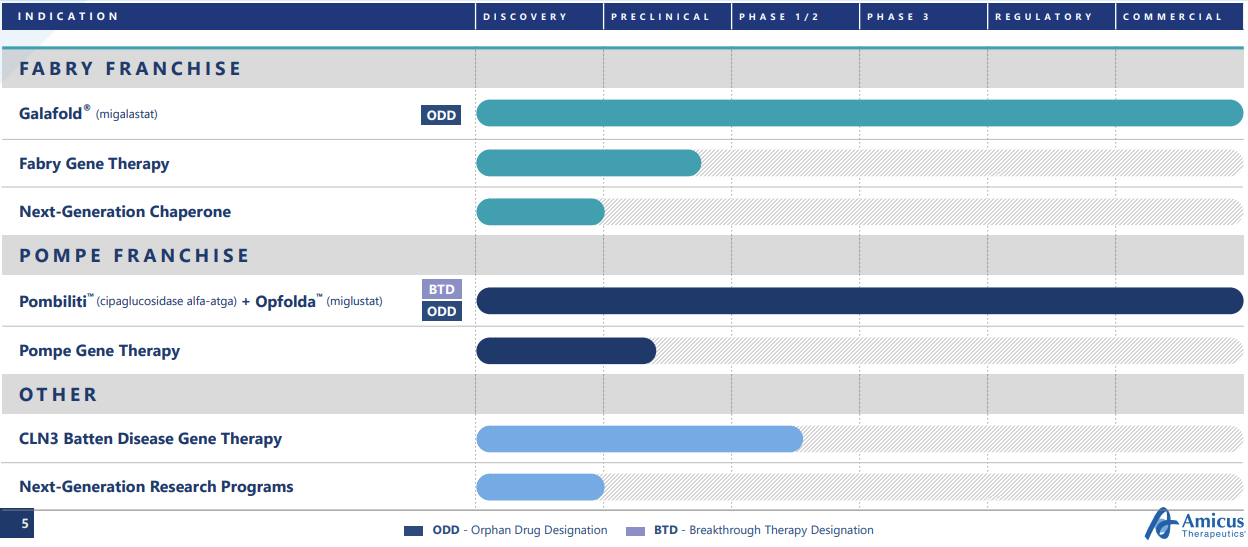

Company Overview & Pipeline

Amicus is a rare disease company focused broadly on the enzyme replacement therapy market, though the early pipeline has now shifted towards gene therapies. It was formed by John Crawley, who had children affected by devastating rare diseases. Amicus’ marketed products include Galafold for Fabry Disease (launched globally), and Pombilti+Opfolda (US, EU, UK launch). The latter combination was recently approved in the US (Sept 2023) and EU+UK (June 2023).

Indication Landscape

Fabry Disease:

Fabry disease is a rare, progressive and devastating X-linked disorder, affecting both males and females, caused by the functional deficiency of lysosomal α-galactosidase (α-Gal). α-Gal is an important enzyme that breaks down various substrates into smaller consistent pieces. In Fabry disease the resulting accumulation of glycosphingolipids, including globotriaosylceramide (GL-3) and globotriaosylsphingosine (lyso-Gb3), can lead to multisystem disease and early death.

Patients are typically started on enzyme replacement therapy (ERT), which requires lifelong bi-weekly intravenous infusions. Delays in ERT initiation or compliance issues can increase the chances of end organ damage, in particular of the heart and kidneys. Additionally, the high infusion frequency leaves patients vulnerable to infections, and some patients develop immune responses to the foreign enzymes.

Pompe Disease:

Pompe Disease, also known as glycogen storage disease type II (GSD II), is a genetic disorder caused by a deficiency of the acid alpha-glucosidase (GAA) enzyme, due to recessive mutations in the GAA gene, which leads to accumulation of lysosomal glycogen. It mainly affects the skeletal and cardiac muscles and the clinical presentation is variable. More than 300 mutations can cause Pompe Disease. Presentation is roughly grouped into infantile and late onset depending on the level of enzyme deficiency. The infant onset disease is typically more severe, characterized by a near lack of enzyme and patients usually die by age one. Late onset Pompe presents mainly as a muscle disease and has a variable course with enzyme levels usually below 30% of normal (link).

The epidemiology is difficult to pin down, and varies considerably by ethnic group. However, experts agree that Pompe Disease, particularly the late onset form, is likely considerably underdiagnosed. Amicus estimates that 5K-10K patients globally have Pompe. Late onset Pompe accounts for ~75% of all diagnosed Pompe cases.

The diagnosis of Pompe disease is ultimately confirmed with enzyme assays and genetic

testing. Clinical history, exam, muscle enzymes, and electromyography (EMG) are the core

of the initial workup and are used to help determine which patient should undergo further

testing specific to Pompe disease.

The advent of newborn screening is creating a problem. Many late onset patients are diagnosed and as many don’t show symptoms until their teenage years it creates a dilemma about how to treat them. Little evidence suggests that early treatment (that is years before symptoms) is beneficial for patients.

Pompe disease modifying treatment revolves around correcting the underlying GAA deficiency, usually with enzyme replacement therapy (ERT). 3 main products are marketed:

Lumizyme (alglucosidase alfa) - First approved ERT for Pompe

Nexviazyme (avalglucosidase alfa) - Next generation ERT

Pombiliti + Opfolda from Amicus

Various supportive care therapies are also used, such as physical therapy etc.

Sales of Pompe ERTs are heading towards $1.5B and constitute and are supported by a growing base of patients. The chronic disease nature further increases revenues.

Source: Amicus Corporate Deck 2023

Alglucosidase alfa was first approved in infant onset Pompe, and while it dramatically improved overall survival the patients it caused problems later in life. Patients lived into their teens and early adulthood and often achieved independent walking, but many began experiencing declines in skeletal muscle strength and developed cardiac arrhythmias. It was later approved for late onset Pompe but the effectiveness wore off after 2–3 years and patients returned to a slow decline (link).

Asset Data

Fabry:

Galafold (migalastat) is Amicus’ flagship product, approved by the EU in May 2016 and by the FDA in Aug 2018 for patients with an amendable GLA variant. Interestingly, the number of amenable mutations initially differed in the European and US labels - 1,384 mutations in the European label and 351 for the US. Now the US has considerably more variants listed in the Prescribing Information (link).

It is an oral small molecule molecular chaperone, designed to bind and stabilize the naturally occurring alpha-Gal A enzyme in patients. It reversibly binds to the active site of α-Gal and enables its transport to the lysosomes where the enzyme catabolizes the accumulated substrates. Importantly, it is not intended for combination use with an enzyme replacement therapy, so patients would have to switch over to the drug or be new users. Amicus estimates that current patients are a mix of switch (~45%) and new patients (~55%).

The Galafold U.S. patent portfolio encompasses 54 Orange Book listed patents, including 10 composition-of-matter patents, of which 38 provide protection through at least 2038.

Phase III - ATTRACT AT1001-011 (NCT00925301, NCT01458119) - Tests vs placebo in ERT naive patients

2 stage study with patients randomly assigned to stage 1 which consisted of 6 months of double blind treatment with either migalastat or placebo. Patient completing stage 1 could get open label migalastat in stage 2 for an additional year. Patients were either ERT naive or had not received it for >6 months prior to enrollment.

Source: link

Some imbalance in the arms with regards to urinary protein excretion and prior ERT use. Interestingly only 11 patients out of 50 were truly ERT naive.

Source: Link

However, the results are clear - migalastat significantly reduced urinary GL-3 and lyso-Gb in patients with amenable mutations. And placebo patients moved to migalastat showed reductions comparable to the double blind migalastat group. Additionally, left ventricular thickness also improved.

The evidence clearly shows that migalastat is superior to placebo on these biomarkers. Now the big question is whether it is better than, or comparable to ERT.

Phase III - ATTRACT AT1001-012 (NCT00925301) - Tests vs ERT (for comparability).

Design included a 6-month randomized, double-blind, placebo-controlled phase followed by a 6-month open-label treatment phase and a 12-month open-label extension phase. Patients received 123 mg GALAFOLD orally every other day.

60 previously ERT treated Fabry patients were randomized 1:1. Assessment of an amenable mutation was done via a HEK assay. 36 patients were switched from ERT to migalastat and 24 remained on ERT. The first patient was enrolled on 8 September 2011. The last patient completed the study on 27 May 2014 and the trial had co-primary end points of annualized change in eGFR and measured GFR.

Source: Link

Overall, the 2 arms are comparable, though hard to say with the relatively small sample size. The ERT arm patients tended to be a little younger and had been diagnosed longer.

At 18 months both ERT and migalastat had comparable effects on renal function.The trial was designed to assess comparability, not superiority of migalastat to ERT, and thus succeeded.

Source: Link

Interestingly, in patients switched from ERT to migalastat left ventricular mass decreased significantly. Other studies also show migalastat’s association with an improvement in cardiac benefits in Fabry patients. For instance, a small study (link) reported a stabilization of left ventricular mass, and improvement trends in various measures such as exercise tolerance. Where there may be small improvement trends, the current label does not indicate any clinical relevant improvements in cardiac outcomes (link).

Pompe:

Pombility + Opfolda was tested in the phase III PROPEL trial, leading to its recent approval. The trial was in late onset Pompe patients who were either on ERT for at least 2 years (ERT experienced) or treatment naive.

Source: Product Website (Link)

At week 52, mean change from baseline in 6-min walk distance (primary endpoint) was 20·8 m (SE 4·6) in the cipaglucosidase alfa plus miglustat group versus 7·2 m (6·6) in the alglucosidase alfa plus placebo group (link). Interestingly, the treatment didn’t achieve statistical superiority over alglucosidase alfa in the overall population for the 6 min walk test, however, significant differences were seen in the ERT naive and ERT experienced groups.

For ERT experienced patients the results were very impressive.

Source: Prescribing Information (link)

But in the ERT naive population, there was no difference between the two products. Though the ERT naive population was a much smaller group, the similar results show that initially both products can have benefit. However, once the effects of alglucosidase alfa reduce in a few years switching products makes sense.

Source: Prescribing Information (link)

The ERT experience population also saw improvements in pulmonary measures. The FVC data was not provided for ERT naive patients, but it’s likely both products were similar.

Source: Product Website (Link)

This data shows that the combination of Pombility and Opfolda can be equivalent to typical ERT in naive patients, and is an especially good option for patients on ERT who have started to decline. We expect physicians to use this option aggressively in patients who are showing decline on first generation ERT.

Amicus’ major new competitor in Pompe is avalglucosidase alfa, a next generation ERT which was recently approved. Its pivotal trial design was a little different with FVC as the primary endpoint. The trial also recruited ERT naive patients who were randomized to avalglucosidase alfa or alglucosidase alfa (the comparator). Patients on the comparator were later switched to avalglucosidase alfa.

The data confirmed non-inferiority but superiority was not reached (link).

Source: Link

Interestingly, the data indicate patients who start first generation products might not do as well long term, even after switching. It’s unclear how physicians will use this option vs Amicus’ combination.

Source: Link

Ownership

Key Financials

Amicus has seen steady revenue growth as Galafold gained a foothold in the Fabry market. With the new Pompe approval the revenue growth could accelerate, particularly as patients on the clinical trial are switched over. The Q4 revenue guidance has been very positive and we expect significant initial update in Pompe, though the final trajectory will depend on product positioning vs the competition. Additionally, EU market launches will add to revenues over the next year.

The markets are baking relatively aggressive revenue increases in the back half of 2024 as the Pompe launch gains traction. Current consensus indicates ~$155M in Q4’24 revenues.

Revenues are driven by Galafold, which crossed $100M per quarter for the first time. The combination in Pompe will take time to ramp up given its recent approval.

Interestingly, 63% of sales are ex-US, an anomaly among biotech companies which often have greater pricing power in the US. One would typically expect the US to account for >50% of sales.

Amicus expects profitability in Q4 2023, which is possible with increasing product revenues due to the Pompe launch and lower clinical R&D spend. In Q3 they missed operational profitability by $17MM.

R&D Expenses - Source: Amicus Q3’23 10Q

A preliminary revenue report indicates that Q4 revenues were $115.1M with the new Pompe product contributing $8.5M (link).

In Oct’23 Amicus entered a $400M loan with Blackstone that matures in 2029. Net proceeds were $387.4M and interest only payments are needed till 2027. Separately, Blackstone also purchased $29.8M of Amicus stock at a price of $12.16. There’s plenty of time for the loan to be paid back so we shouldn’t worry too much about it, particularly as revenues increase.